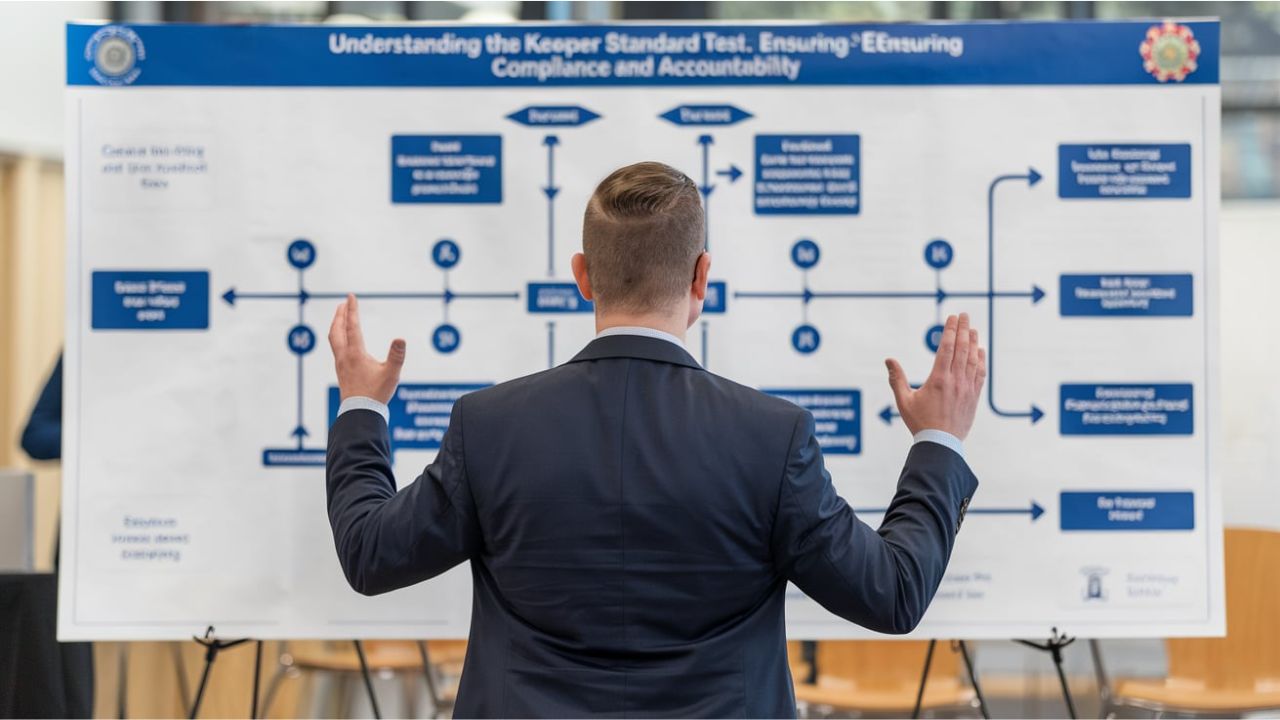

The keeper standard test plays a critical role in financial practices, ensuring compliance, accountability, and proper management of fiduciary responsibilities. Whether in business operations, legal settings, or financial audits, this test serves as a benchmark for evaluating the conduct and integrity of individuals and organizations managing funds.

This guide provides an in-depth look at the keeper standard test, its purpose, how it works, and why it is a vital tool for maintaining ethical and legal standards in finance.

What is the Keeper Standard Test?

The keeper standard test is a framework or set of criteria used to assess whether individuals or organizations entrusted with financial responsibilities act with appropriate care, diligence, and compliance. It ensures that fiduciaries, or “keepers” of funds, maintain the integrity of financial operations.

This test is often applied in legal and financial audits, helping determine accountability in situations where funds may have been mismanaged or misappropriated.

The Purpose of the Keeper Standard Test

1. Ensuring Accountability

The test ensures that individuals managing financial responsibilities are held accountable for their actions, protecting stakeholders’ interests.

2. Promoting Ethical Practices

It emphasizes adherence to ethical standards, reducing risks of fraud and negligence.

3. Enhancing Transparency

By setting clear benchmarks, the test fosters transparency in financial management.

4. Mitigating Legal Risks

Proper application of the test helps organizations avoid legal complications arising from non-compliance or mismanagement.

Key Elements of the Keeper Standard Test

1. Fiduciary Responsibility

The test evaluates whether the fiduciary has acted in the best interests of the stakeholders.

2. Due Diligence

It examines the thoroughness of actions taken to ensure financial accuracy and compliance.

3. Record-Keeping

Proper documentation and accurate records are a cornerstone of the keeper standard test.

4. Adherence to Legal Standards

The test ensures that all financial practices comply with applicable laws and regulations.

When is the Keeper Standard Test Applied?

1. Corporate Financial Audits

Auditors use the test to evaluate how corporations handle financial responsibilities.

2. Legal Proceedings

In cases of financial disputes or allegations of misconduct, the test helps establish accountability.

3. Non-Profit Organizations

Non-profits often undergo the keeper standard test to ensure donations are used responsibly.

4. Government and Public Sector

Government agencies apply the test to maintain transparency in handling taxpayer money.

How the Keeper_Standard_Test Works

1. Define Responsibilities

Identify the fiduciary’s specific roles and obligations.

2. Analyze Financial Practices

Examine the processes used to manage funds, including budgeting, allocation, and reporting.

3. Evaluate Documentation

Review financial records for accuracy, completeness, and compliance with standards.

4. Identify Breaches

Highlight any discrepancies, unauthorized transactions, or breaches of fiduciary duties.

5. Recommend Improvements

Provide actionable insights to rectify any issues and improve financial management.

Benefits of the Keeper Standard Test

1. Protects Stakeholders

The test safeguards the interests of investors, donors, and other stakeholders by ensuring ethical financial management.

2. Builds Trust

Organizations that comply with the keeper_standard_test foster trust among their clients, partners, and the public.

3. Reduces Financial Risks

By identifying vulnerabilities in financial practices, the test minimizes risks of fraud and errors.

4. Supports Legal Compliance

Organizations can avoid penalties and legal challenges by adhering to the test’s standards.

Challenges in Applying the Keeper Standard Test

1. Complex Financial Systems

The complexity of modern financial systems can make it challenging to apply the test uniformly.

2. Resistance to Transparency

Organizations reluctant to disclose financial details may hinder the test’s effectiveness.

3. Evolving Regulations

Constant changes in financial laws require frequent updates to the test’s criteria.

Best Practices for Passing the Keeper Standard Test

1. Maintain Accurate Records

Ensure all financial transactions are documented and stored securely.

2. Conduct Regular Audits

Frequent internal audits help identify and address potential issues proactively.

3. Provide Training

Educate staff about fiduciary responsibilities and compliance standards.

4. Use Technology

Leverage financial management software to streamline processes and enhance accuracy.

FAQs

What industries commonly use the keeper standard test?

It is widely used in corporate finance, non-profit management, government agencies, and legal proceedings.

Can small businesses benefit from the keeper_standard_test?

Yes, small businesses can use the test to ensure financial integrity and build trust with stakeholders.

Is the keeper standard test mandatory?

In some industries, applying the test is a regulatory requirement. In others, it is a best practice.

What happens if an organization fails the keeper_standard_test?

Failure can result in legal action, financial penalties, or reputational damage, depending on the severity of non-compliance.

Can technology simplify the keeper_standard_test?

Yes, financial management software and tools can make the process more efficient and accurate.

How often should the keeper_standard_test be applied?

It depends on the organization’s size and industry, but annual or semi-annual evaluations are common.

Conclusion

The keeper standard test is a vital tool for ensuring accountability and transparency in financial management. By promoting ethical practices and reducing risks, it safeguards stakeholders’ interests and enhances trust in organizations. Adopting the keeper_standard_test not only ensures compliance but also strengthens the foundation of any entity’s financial operations.

Whether you’re a small business owner, a non-profit manager, or a corporate executive, integrating the keeper_standard_test into your practices is a smart step toward financial security and long-term success.